Thank you for your donation!

Are you looking for a tax receipt for your donation?

Fully Paid Donations

If you donated to the United Way in 2023 online you should have received your tax receipt via email right after completing the transaction. The subject of the email would have been ‘Your United Way Tax Receipt’. Sometimes these get caught in email SPAM filters.

If you donated by cheque or cash, your tax receipt would have been mailed or sent by email within a month of United Way receiving your donation. Monthly credit card donors will be their tax receipts in January 2024.

A tax receipt would have been mailed to you if you transferred securities to the United Way.

If you require a duplicate receipt, please email us at database@unitedwaykfla.ca or give us a call at 613-542-2674 and we will be happy to get you a duplicate tax receipt.

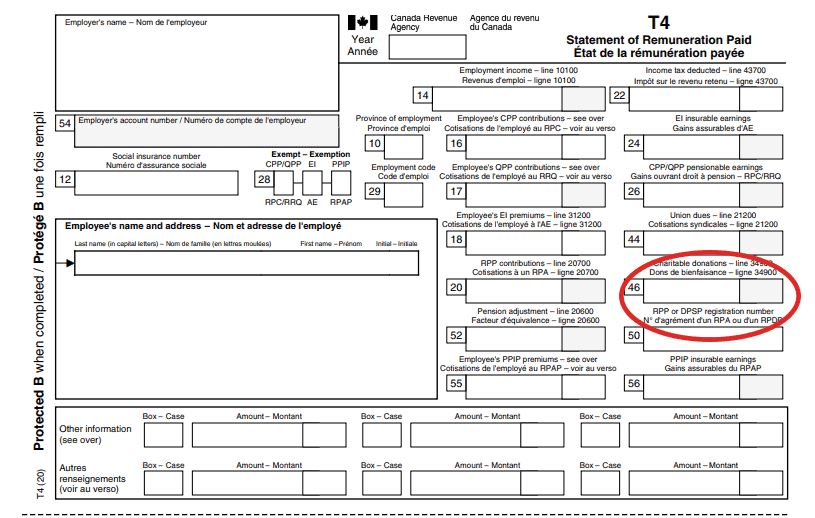

Payroll Deduction Donations

If you donated to the United Way using the easy and convenient way of payroll deductions by your employer, you don’t need a tax receipt. All of your donations deducted from your pay in 2020 will appear in box 46 of your T4 statement produced by your employer. You can use this information to file your income tax return.

United Way of KFL&A would like to acknowledge this traditional territory’s longer existence and its significance for the Indigenous people who lived and continue to live on Turtle Island.

We are situated on traditional Anishinaabe, Haudenosaunee and Huron-Wendat land. There are Métis and other non-status First People from many Indigenous Nations present in our community today. This acknowledgement symbolizes the United Way KFL&A’s first step, of many, along this path toward Indigenous reconciliation, in a respectful manner.

"*" indicates required fields